2020: Reading list

What all terms will we eventually associate with 2020? For me, and possibly many others, 2020 will evoke at various times, emotions like anxiety, fear, panic, helplessness, sorrow, and weariness. The eerie experience tucked in some corner of our amygdala will stay with most of us forever. Towards the end, the year also brought some hope albeit rolled in trepidation. For stock market professionals there was not much to complain about even though first quarter of the year had seemed like a journey to hell. However, the year was also about learning – introspection, reworking of priorities, and reading. Below is a list of good books that I managed to read over last 12 months- and would recommend to those who want to learn from thoughts, experience, research and work of others.

- Investing: The Last Liberal Art – Robert Hagstrom – Super-investor Charlie Munger insists that fundamental investment has to be based on a lattice work of mental models drawing on concepts from a wide variety of subjects. This book does an amazing job in connecting the dots between practice of investment, and some unlikely fields like physics, biology, philosophy, literature, sociology etc apart from the usual suspects like economics and psychology. With prompt examples and riveting stories, Hagstrom (known better as the author of the widely acclaimed book “The Warren Buffet Way”) highlights the source of many important concepts in investing from these other streams of knowledge.

- The Silk Roads – Peter Frankopan –Globalization has been a buzz word for quite a while now. However, the process of globalization has been taking place for millenniums even if in different forms. The Silk Roads traces the world’s history along trade routes many of which were also used for military campaigns. These routes obviously facilitated interplay of tribes, traditions, mythologies, ideas, and cultures to help human society evolve. Flipping through this book is like having a window view of mankind’s development in last two thousand years. The book makes one think more, and raises some more questions. Covering large periods of known history this easy to read book understandably skips and breezes through centuries but nevertheless is riveting enough with its unique theme.

- A Book of Simple Living: Notes From the Hills – Ruskin Bond – Life in the Himalayas, beauty of flowers, interaction with a thrush, winter chill, smell of pre-monsoon soil, dreams, watching the world from a window, loneliness, contentment, nostalgia, happiness – this is what Ruskin Bond’s readers expect from his books. This is one book where the author has laid down his life lessons in a more direct fashion, of course weaving them in stories in his usual crisp, witty and simple style. One gem – “Happiness is a mysterious thing, to be found somewhere between too little and to much”.

- Meditations- Markus Aurelius –A treatise on how to lead a satisfied and productive life by one of the last masters of Greeko-Roman stoic school of philosophy. This book puts together the learnings, thoughts, and reflections of the last of the so called five good emperors of Rome from the triple lenses of logic, ethics and science. By the way, this beautiful way of looking at and leading life has many common elements in the ancient Indian philosophy too.

- Never Split the Difference– Chris Voss – Based on interesting incidents during the author’s career as FBI’s kidnapping negotiator this book can help develop a practicable framework for success in negotiations – and in day-to-day conflicts- by superimposing tools of emotional intelligence, psychology, and game theory on lessons from high pressure, real life situations.

- The Richest Man in Babylon– George S Clason – In refreshingly simple and practical terms this book offers fundamental insights on creating and retaining wealth. Compiled more than 90 years ago, the book – based on parables in the context of ancient Babylon written by George Clason- provides nuggets of wisdom that will always be relevant. These principles can not only lead to wealth but also to happiness given that they are based on the right and highly practical moral compass.

- Six not so easy pieces– Richard Feynman –Six not so easy pieces is a compilation of introduction of some fundamental topics of modern physics from lectures delivered by the legendary physicist Richard Feynman in 1960’s at Caltech. It takes the readers on a quick exploration of the secrets of universe. Using a philosophical approach without missing out on the mathematical elegance of physics, this book will require some effort from people who have not been involved in physics for a while, but the effort will be worth the gains.

- Maths Copy and Other Vignettes– Dr Pulak Puneet – Pulak Puneet has presented life in a rainbow of colours with his stories. There is a dose of nostalgia and some sprinkling of life lessons learnt while growing up to be, and working as, a doctor. The innocent fears and the curiosity of a child, the swagger and the self-doubt of a young adult, snippets from a medicine school campus, and life as a doctor are all depicted in a delightful manner.

- Thinking in bets– Annnie Duke –This book highlights some practical aspects of behavioural economics with many interesting anecdotes especially from the world of poker. This is a good work on how to look within, to understand ourselves, and to avoid poor decisions. The author tries to emphasise the difference between luck and skills/ decisions so that we can understand and mitigate risks.

- The Expectations Investing– Alfred Rappaport, Michael Maubossin – With its emphasis on fundamental rigours of corporate finance and cash flow analysis this book seems to be more from the stable of Rappaport than of Maubossin. Here the premise is that stocks are priced at any point in time, as per consensus expectations. The authors are suggesting to work backward on the path of fundamental investing – by trying to figure out based on a DCF model, what is a stock’s price implying. The price implied expectations of value drivers are then contrasted with the potential changes in these value drivers in future. These potentially changed value drivers give us a good idea of the stock price target. Thus, what one is trying to benefit from is the change in market’s expectations regarding a stock. An intense but high value-add book.

- The Signal and the Noise– Nate Silver –An excellent one on prediction and on why some predictions are right and why some fail. With some gripping anecdotes Nate Silver takes the readers on a journey to explore uncertainty, decision making, risks, innovation, ideas and learning. This is not a “How to” book, but rather strives to peel off our blind spots to make us better aware of ourselves, and better prepared for future.

- Prisoners of Geography– Tim Marshall – When it comes to geopolitics, diplomats and governments change fast, political systems get transformed, neighbours change with redrawing of international borders, and even history gets rewritten with time. What stands still is geography. It is for this reason that getting down to the roots of geography is the key to understand the trends in ideas and new movements. Tim Marshall picks up some important regions on the globe and does a great job analysing the salient point in their geography and the way the latter shapes that region’s economic and military capabilities, politics, culture and international relations. Easy read but lots of learnings.

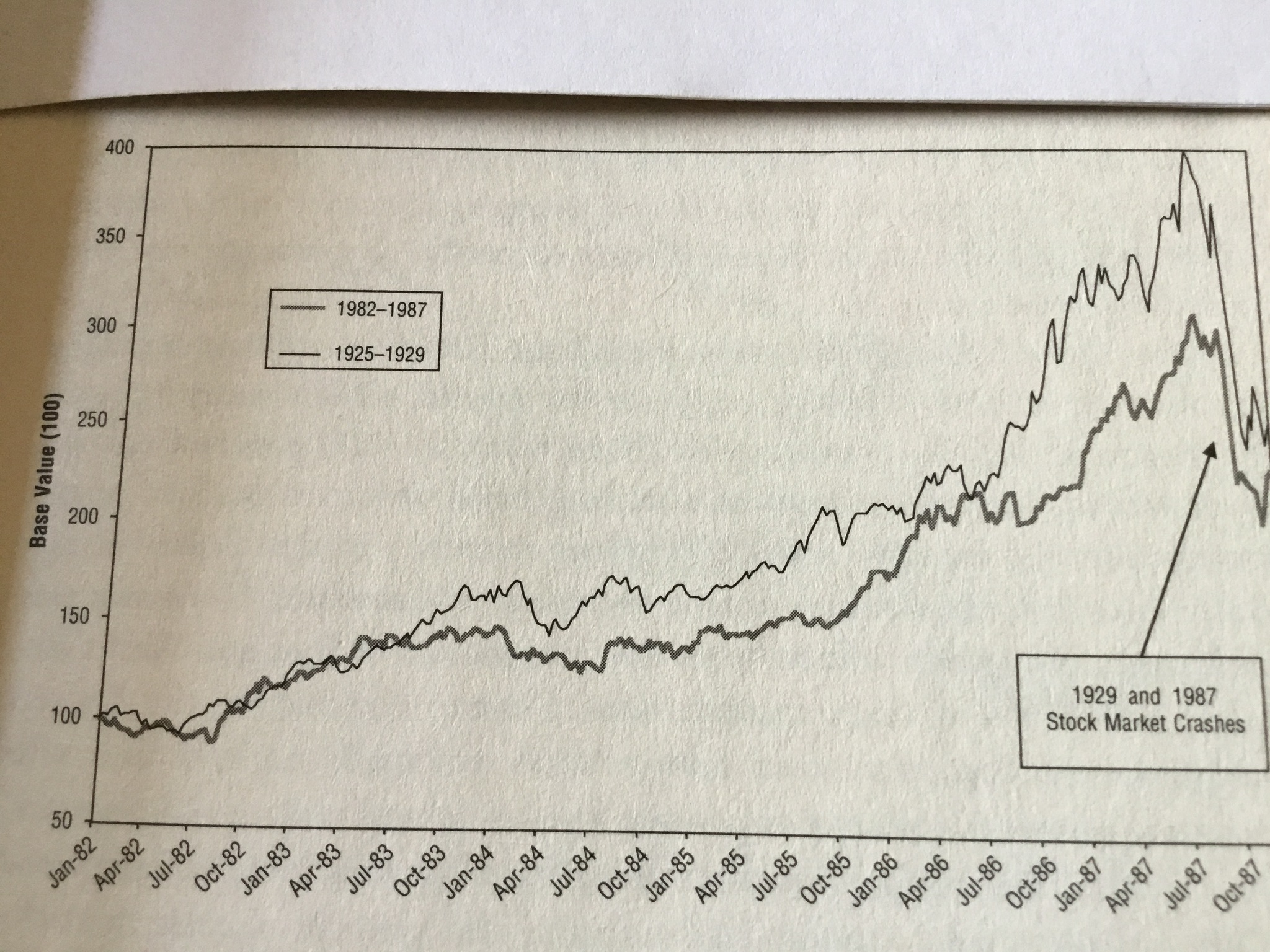

- Mastering the market cycle– Howard Marks –For many long-term, bottom-up fundamental investors the idea of catching market cycles is akin to timing the market which in turn is like a red rag. However, whether we like it or not, as investors we have to try to avoid the deep, prolonged bear markets. This book – in classic Howard Marks style of simple language combined with lessons from history, macroeconomics and psychology- does not claim to teach how to predict market cycles movements. Instead, it helps us spot the point – or region – where we are in the cycle at any juncture and thus helps us be prepared for cyclical moves in the market.

- Introducing Nietzsche: A graphic guide – A summary of the works of the maverick philosopher who had the guts to challenge many basic notions of truth, morality, science, religion and philosophy. Most of his thoughts were outright, but naturally, provocative and often conflicting with each other.

- Rise and Fall of the great powers– Paul Kennedy – This is a fascinating and gripping account of change of baton of global leadership on multiple occasions in the period between 16th century and 20th century. The author has explained the interplay of resource availability, culture, education, geography, and strategic and military depth- in emergence and then eclipse of various world leading powers in the last 500 years, in a nuanced fashion. This is an easy read and with these stories the reader gets transported back in time and gets lots to ponder over.

- The Outsiders– William N Thorndike, Jr – The outsiders follows the paths of eight business leaders – who were radically different from the run-of-the-mill CEO’s, and the companies they ran. They were all different from each other too in their leadership styles but they were all extremely successful. Some traits were common though – intense focus on customers, excellence in capital allocation, and unwavering intent on shareholder value creation.